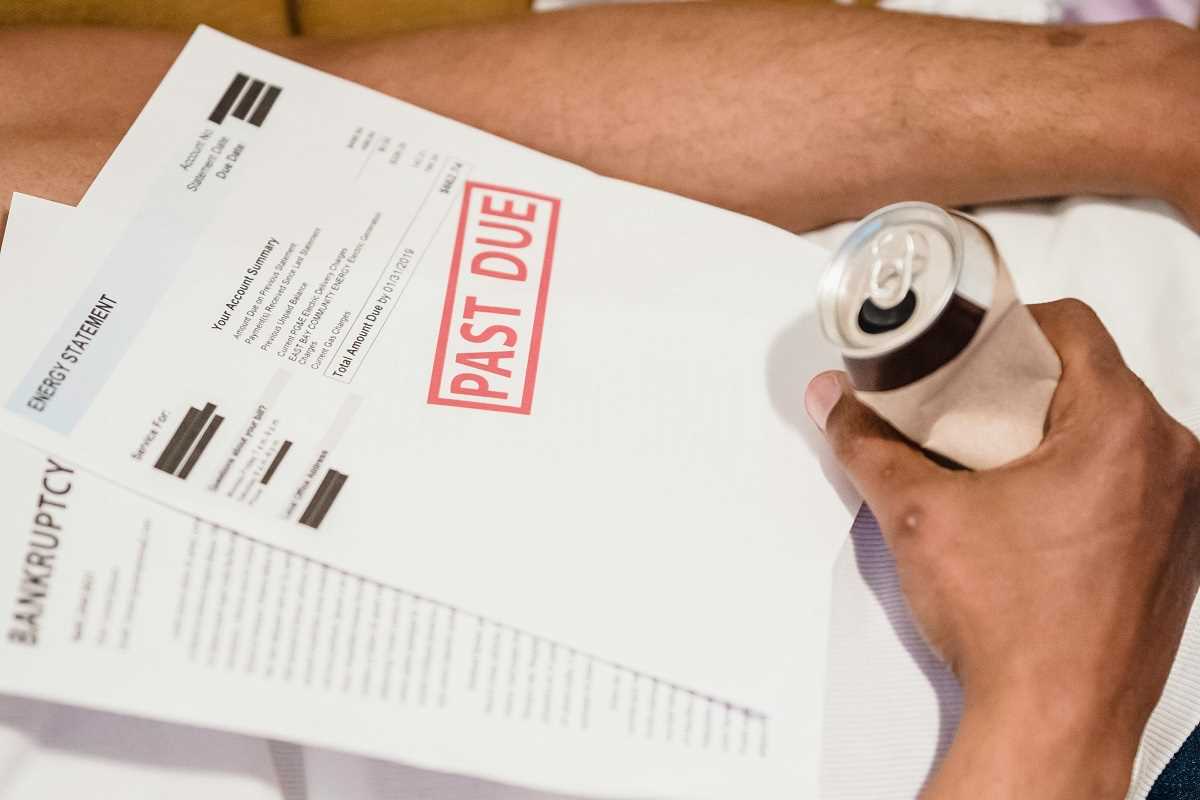

In times of uncertainty, managing your finances can feel overwhelming and stressful. Economic downturns, job instability, and unexpected expenses can shake our financial foundations and challenge our financial habits. Through effective financial management strategies you can regain control, minimize stress, and create a more secure financial future. Here are some effective tips to help you manage your finances during uncertain times:

Budgeting Wisely

Creating a budget is crucial for understanding your income and expenses. A budget serves as a financial roadmap, allowing you to allocate funds effectively and monitor your spending habits. Here’s how to get started:

- Assess Your Income: Begin by calculating your total monthly income. Include all sources of income, such as your salary, side gigs, and any passive income.

- Track Your Expenses: Next, track your monthly expenses. Break them down into fixed (rent, utilities) and variable (groceries, entertainment) expenses. This will give you a clear picture of where your money is going.

- Prioritize Essential Expenses: Allocate funds for essential expenses first, such as groceries, rent, and utilities. Once these are covered, you can focus on savings and debt payments.

- Adjust as Needed: Your budget is a living document that should be reviewed regularly. If you notice you're overspending in certain categories, adjust your budget to reflect your actual spending habits.

- Utilize Budgeting Tools: Consider using budgeting apps or software to simplify the process. Tools like Mint, YNAB (You Need A Budget), or even a simple spreadsheet can help you stay organized and accountable.

A well-structured budget can help you make necessary adjustments to your spending habits and ensure that you’re living within your means, even in uncertain times.

Emergency Fund

Having an emergency fund is a critical component of financial stability, serving as a financial safety net for unexpected expenses or a sudden loss of income. Here’s how to build and maintain an emergency fund:

- Determine Your Target Amount: Aim to save three to six months' worth of living expenses. This amount will vary based on your personal circumstances, including your income, expenses, and any potential risks you may face.

- Open a Separate Savings Account: Keep your emergency fund in a separate, easily accessible savings account. This will help you avoid the temptation to dip into it for non-emergency expenses.

- Automate Your Savings: Set up automatic transfers to your emergency fund each month. Treat it like a bill that needs to be paid. Even small contributions can add up over time.

- Replenish When Used: If you ever need to use your emergency fund, make it a priority to replenish it as soon as possible. Life is unpredictable, and having that financial cushion is essential for future stability.

- Review Your Fund Regularly: As your circumstances change, review your emergency fund. If your expenses increase, aim to adjust your savings target accordingly.

An emergency fund can help cover essential costs during tough times without relying on credit cards or loans, providing peace of mind during periods of financial uncertainty.

Cutting Back on Non-Essential Expenses

During uncertain times, it's wise to cut back on non-essential expenses to free up more money for savings or emergencies. Here are some strategies to identify and reduce discretionary spending:

- Evaluate Your Spending Habits: Take a close look at your monthly expenses. Identify discretionary spending categories, such as dining out, entertainment, and subscription services.

- Prioritize Needs Over Wants: Differentiate between essential needs and non-essential wants. Focus on spending money on what truly enhances your life and well-being.

- Create a Spending Plan: Set a limit for discretionary spending each month. Stick to this budget to avoid overspending.

- Find Alternatives: Look for free or low-cost alternatives to your usual activities. Instead of dining out, try cooking at home, or explore free community events instead of expensive entertainment options.

- Practice Mindfulness: Being mindful of your spending can help you make more intentional decisions. Before making a purchase, ask yourself if it aligns with your financial goals and if it truly brings you joy.

By being intentional with your spending, you can prioritize your financial goals and create more breathing room in your budget.

Reviewing and Adjusting Investments

Keeping a close eye on your investments during times of uncertainty is crucial for protecting your financial future. Regularly reviewing and adjusting your investment strategy can help minimize risks and enhance your financial stability. Here’s how to navigate your investments during uncertain times:

- Review Your Portfolio: Periodically assess your investment portfolio. Look at the performance of your assets and ensure they align with your financial goals.

- Consider Diversification: Diversifying your investments can minimize risks. Spread your investments across different asset classes, such as stocks, bonds, and real estate, to reduce the impact of market volatility.

- Stay Informed: Keep abreast of market trends and economic indicators. Understanding the broader economic landscape can help you make informed investment decisions.

- Consult a Financial Advisor: If you’re unsure about your investment strategy, consider seeking guidance from a financial advisor. A professional can provide personalized advice based on your risk tolerance and financial goals.

- Avoid Panic Selling: In times of market volatility, it can be tempting to panic and sell off investments. Resist this urge and instead focus on your long-term financial objectives.

Regularly reviewing your investments and staying informed can help you make sound decisions that align with your financial strategy.

Increasing Income Streams

Consider supplementing your income by exploring additional ways to earn money. In uncertain economic times, diversifying your income sources can provide a financial buffer and greater security. Here are some ideas to increase your income streams:

- Side Hustles: Explore opportunities for side jobs or freelance work. Whether it’s driving for a rideshare service, offering consulting services, or taking on freelance writing or design projects, side hustles can provide extra cash flow.

- Sell Unused Items: Look around your home for items you no longer need or use. Selling these items online or at a garage sale can generate extra income while decluttering your space.

- Invest in Your Skills: Consider taking courses or certifications to enhance your skills. This can open up new job opportunities or allow you to command higher pay in your current position.

- Passive Income Streams: Look for ways to generate passive income, such as investing in rental properties or dividend-paying stocks. While these options may require upfront investment, they can provide ongoing income over time.

- Network: Connect with professionals in your field and seek out opportunities for collaboration or mentorship. Networking can lead to job opportunities or new income streams.

By actively seeking ways to increase your income, you can build a more robust financial foundation and lessen the impact of economic uncertainty.

Managing Debt Wisely

If you have existing debt, focus on managing it strategically during uncertain times. High levels of debt can exacerbate financial stress, so it's crucial to have a plan in place. Here are some effective strategies for managing debt:

- Prioritize High-Interest Debts: Identify which debts carry the highest interest rates and focus on paying those off first. This strategy can save you money in interest payments over time.

- Consider Debt Consolidation: If you have multiple debts, consider consolidating them into a single loan with a lower interest rate. This can simplify your payments and potentially reduce your overall interest costs.

- Negotiate with Creditors: Reach out to your creditors to discuss your situation. Many lenders are willing to work with you to create manageable payment plans or lower interest rates during difficult times.

- Avoid Taking on New Debt: Resist the temptation to take on new debt unless absolutely necessary. Focus on living within your means and paying off existing debts.

- Seek Financial Counseling: If you're struggling with debt, consider seeking help from a certified financial counselor. They can provide personalized advice and strategies for managing your debts effectively.

By managing debt wisely, you can alleviate financial stress and position yourself for better financial stability during uncertain times.

Seeking Professional Guidance

In times of uncertainty, seeking guidance from a financial advisor can provide valuable insights and strategies to navigate challenging situations. Professional advice can be especially beneficial if you feel overwhelmed or unsure about your financial decisions. Here’s how to find and work with a financial advisor:

- Identify Your Needs: Determine what areas of your finances you need help with, such as budgeting, investments, retirement planning, or debt management.

- Research Potential Advisors: Look for financial advisors who specialize in your areas of concern. Check their qualifications, experience, and client reviews to ensure they are reputable.

- Ask Questions: During initial consultations, ask potential advisors about their approach, fees, and how they can help you achieve your financial goals.

- Establish Clear Goals: Work with your advisor to set clear financial goals. A good advisor will help you create a tailored financial plan that reflects your needs and objectives.

- Review Progress Regularly: Schedule regular check-ins with your advisor to review your financial plan and make adjustments as needed. Financial landscapes can change, so staying engaged is important.

By seeking professional guidance, you can gain confidence in your financial decisions and develop a comprehensive plan for your financial future.

Staying Proactive and Flexible

The key to managing finances during uncertain times is to stay proactive and flexible. Economic conditions can change rapidly, and being adaptable can help you navigate challenges more effectively. Here are some additional strategies to maintain a proactive mindset:

- Regularly Review Your Financial Situation: Make it a habit to review your finances regularly. This includes your budget, expenses, investments, and debt levels. Regular check-ins can help you stay on track and make adjustments as necessary.

- Set Short- and Long-Term Goals: Establish both short- and long-term financial goals. Short-term goals can include saving for a vacation or paying off a specific debt, while long-term goals may involve retirement planning or purchasing a home.

- Educate Yourself: Invest time in learning about personal finance. Read books, attend workshops, or follow reputable financial blogs and podcasts. The more knowledgeable you are, the better equipped you'll be to make informed decisions.

- Build a Support Network: Surround yourself with like-minded individuals who prioritize financial wellness. Share experiences and strategies with friends or family members who can provide support and encouragement.

- Practice Self-Care: Managing finances can be stressful, so don’t forget to take care of your mental and emotional well-being. Find healthy outlets for stress, such as exercise, meditation, or hobbies that bring you joy.

Remember that financial uncertainty is a part of life, but with the right strategies in place, you can weather any storm and emerge even stronger. By taking charge of your financial situation, you empower yourself to achieve stability and security, no matter what challenges may come your way.

(Image via

(Image via